BISON CHINA FLEXIBLE BOND FUND

Fund's Shares in USD, EUR and CNY

Exposure to Chinese issuers of high credit quality

Daily subscriptions and redemptions and an adequate degree of diversification

Description of the Fund

The objective of the Fund is to provide participants with an investment composed of liquid assets, mostly bonds from Chinese issuers.

The Bison China Flexible Bond Fund will have the following maximum investment limits, in terms of the Fund’s Net Asset Value (FNAV):

- Money Market Instruments and Money Market Funds: 100%

- Chinese Government Bonds or State-Owned Enterprises: 50%

- Bonds issued by Chinese companies with Investment Grade rating: 30%

- Bonds issued by Chinese Financial Institutions with Investment Grade rating: 50%

- Bonds of High Yield Chinese Issuers: 30%

- Bonds of Chinese Issuers with no rating: 10%

- Direct investment in cumulative exposure of CNH and CNY: 50%

- Shares in other Funds: 20%

| ISIN | CAT. A USD: PTLYNAHM0009 CAT. B EUR: PTLYNBHM0008 CAT. C CNY: PTLYNCHM0007 |

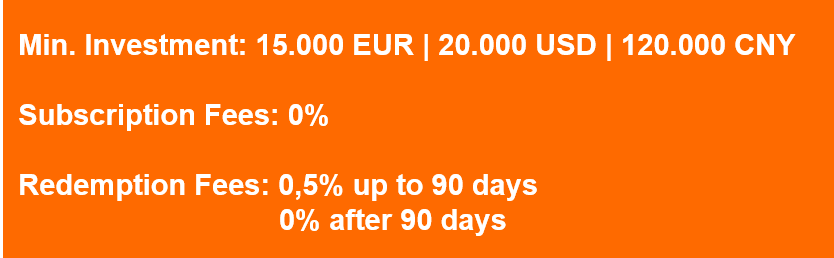

| Minimum initial subscription amount | 15.000 EUR | 20.000 USD | 120.000 CNY |

| Amount of subsequent subscriptions | 1.000 EUR | 1.000 USD | 7.000 CNY |

| Subscription Fees | 0% |

Redemption Fees |

0,5% up to 90 days (including) 0% after 90 days |

| Fees charged to the Fund | 1,56% (expected value) |

| Risk | CAT. A USD: 3 CAT. B EUR: 4 CAT. C CNY: 3 |

Information and Documentation

Disclaimer

The value and return resulting from the investments may fall or rise and, consequently, the value of the units may decrease or increase depending on the evolution of the assets that make up the fund, with higher returns being normally associated with greater risk. Due to economic and market risks, there is no guarantee that the fund will achieve its objectives. It should be noted the investment in the collective investment undertaking may result in the loss of capital invested.

Commercialization Entity: Bison Bank, S.A. – Share Capital: €195,198,370.00 – C.R.C. Lisboa with NIPC 502 261 722, with headquarters at Rua Barata Salgueiro, 33, Piso 0, 1250-042 Lisbon – Portugal.

Management Entity: Lynx Asset Managers SGOIC, S.A. – Share Capital: €1.850.000,00 – C.R.C. Lisboa with NIPC 507 929 934, with headquarters at Avenida duque de Ávila, Nº 185, 4ºD 1050-082 Lisbon – Portugal.

The information provided does not exempt with the careful and detailed reading of the Key investor information Document (KIID), the Full Prospectus and the Distributor’s Particular Conditions, which contain the conditions applied to the Fund’s subscription and redemption operations, documents available here and which you should read carefully before considering and making any investment decision.

Any decision based on the information contained in this electronic communication is its own responsibility, and no liability arising from that decision can be attributed to Bison Bank, S.A..

The Key investor information Document (KIID) and the full prospectuses are also available in all locations and venues of commercialization, as well as at CMVM’s website – www.cmvm.pt.